A funny thing happened when President Biden went off script during his recent State of the Union speech and began jousting with a raucous group of Republican lawmakers.

He told the truth.

Now, that’s not to say the rest of what he said was lies, but in this unscripted moment, which began just as he was talking about climate change, he injected a moment of reality into his speech.

“We’re still going to need oil and gas for a while,” he said, probably to the chagrin of his speech writers.

READ — Understanding ESG & Colorado’s Energy Transformation

He then quickly added, in another off-the-cuff remark, that we’re going to need oil for “at least a decade.” It drew laughs from Republicans because, as conservative Jonah Goldberg tweeted, that’s like saying we’ll need water and oxygen for “at least a decade.”

Even though President Biden has continuously vilified this industry and made it harder to develop our natural resources, beginning with campaign pledges to shut down all drilling to his first few days in office when he shut down the Keystone pipeline and froze federal leasing, his unscripted moment brought a much-needed dose of reality to our national conversation on energy.

We need oil and natural gas to survive. And will, for years to come. Not just a decade.

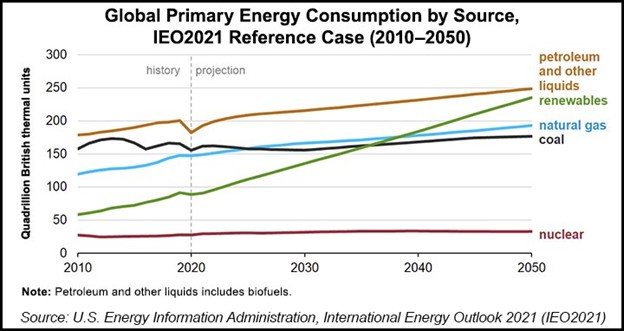

The federal government, through its Energy Information Administration, projects that by 2050, we will need more oil and natural gas than today, not less. (To be fair, they also expect an even greater share of renewables in our energy mix.)

The global population is growing, and access to efficient, reliable and affordable energy is a human right. We will need all forms of energy to thrive, and attacking domestic production, shutting down infrastructure and making it harder to develop here only means we’ll rely on foreign countries for our energy, which is not an environmental solution and makes our country less secure.

READ — Do Hispanics Bear the Brunt of the Energy Crisis?

Today, oil and natural gas are the primary sources of energy for the global economy, supplying roughly 70 percent of the total global energy demand. In 2021, 81 percent of our primary energy in the United States came from fossil fuels. We will continue to need oil and natural gas for decades to come for many reasons. It is our challenge to produce it cleaner, better and safer here than anywhere on the globe.

But we need realistic conversations about where our energy comes from, and the trade-offs and benefits of all energy sources.

In Colorado, the governor recently renewed his pledge to move our state to 100 percent renewable energy by 2040. But just a few days prior, for nearly three days when the temperature hovered around 0, renewables provided almost no power to our electrical grid as the wind wasn’t blowing and the sun wasn’t shining. Natural gas and coal were the workforces that kept us safe and warm during that cold snap.

Knowing that we need these resources, we need to do a better job of sharing the positive environmental changes we’ve seen in recent years: The new technologies, the lowering of emissions and the promise of innovation and ingenuity. Our elected leaders need to embrace that as well.

If you’re concerned about climate change, it’s important to note that today we’re powering our electric grid with more natural gas, wind, and solar energy than ever before. The environmental benefits have been, and will continue to be, profound because natural gas, as an energy source, has a low carbon dioxide emissions profile.

But that’s just part of the story. Numerous emissions reductions beyond CO2 have occurred as a result of this trend, with sulfur dioxide down 88 percent and ground-level ozone down 22 percent. The six most common pollutants (PM2.5 and PM10, SO2, NOx, VOCs, CO and Pb) are collectively down 73 percent. That’s a tremendous success story for our environment and our air quality.

In Colorado, we also can be proud that methane emissions from oil and natural gas production are decreasing, and our industry’s volatile organic compound (VOC) emissions have dropped nearly 60 percent since 2011. Technology improvements and regulations that reduce the chance for methane and VOCs to escape into our atmosphere are working.

Our industry continues to make tremendous progress in both the efficiency of energy consumption and in reducing greenhouse gases. However, more work must be done.

We can have the economy we desire and the environment we need, but we need to have realistic conversations about climate, where our energy comes from and what’s feasible. We also need to support policies and infrastructure that allows for continued domestic production, especially here in Colorado where we’re producing some of the cleanest molecules of energy on the planet.

Clean, affordable energy is the key to our world’s future, and oil and natural gas have an important role to play.

Dan Haley is president and CEO of the Colorado Oil & Gas Association.