Preparing for Economic Downturn: 4 Tips for Colorado Business Owners

How Colorado business owners can develop and implement recession-proof strategies.

Steve Swinney //June 30, 2023//

Preparing for Economic Downturn: 4 Tips for Colorado Business Owners

How Colorado business owners can develop and implement recession-proof strategies.

Steve Swinney //June 30, 2023//

Approaching the mid-way point of 2023, the economic downturn that many predicted would characterize Colorado’s economy this year hasn’t materialized. Despite uncertainty and rising interest rates, economic indicators appear to show a resilient market. But, there is a natural cycle of economic highs and lows that all business owners have to confront at times. As we approach the second half of the year, it’s a good time to examine your position and ensure you have some intentional strategies in place to avoid “survival mode” when a downturn does present itself.

Balancing various economic variables in a way that protects profits and cash flow, especially in a downturn, is one of the biggest challenges that business owners must address. The most successful business leaders keep a finger on the pulse of economic cycles and are prepared with both short- and long-term plans to respond to variable market conditions.

READ: 5 Ways Small Business Owners in Colorado Can Survive Inflation

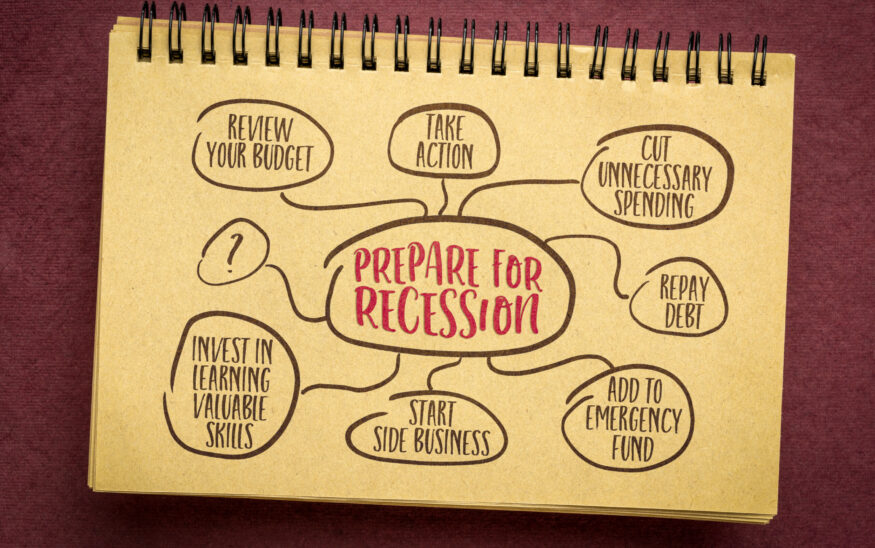

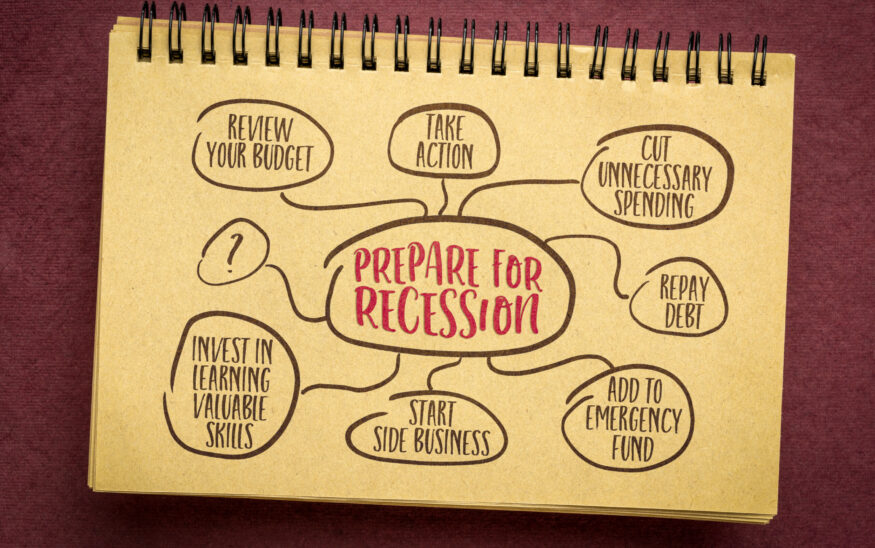

Here are four tips that can help Colorado business owners prepare for a downturn:

Proactively manage production, sales and workforce

These three functions of business, more than any other, can provide a steadying ground for businesses during periods of economic downturn or sustained declines in demand. Business owners can create a cushion to protect themselves from the market and avoid making knee-jerk reactions by getting ahead in these areas.

Look to optimize your accounting department and focus on data-driven forecasting. With better data, executives will have the upper hand when it comes to predicting slower periods. This information gives you more time to prepare and make sound decisions before you feel the full impact of a downturn.

Human resources is another key area that can make or break a company’s ability to weather a downturn. Set up systems to ensure you have flexibility in managing your workforce. Avoid costly hiring-firing cycles that economic swings can set off by creating an all-the-time loyal workforce. Invest in workforce development. Look for opportunities to decentralize your management structure to offer more autonomy for decision-making. A culture that engages people will always be more resilient in tough times.

Work to ensure your product or service is creating essential value for your customers

Companies that create products or deliver services that people cannot live without will protect revenue during a recession because you’re unlikely to see major changes to demand. When the economy forces Coloradans to look for more ways to save, we naturally start evaluating needs and wants. Business owners who’ve positioned their product or service firmly in the ‘need’ category will fare better because a downturn has little impact on the value of something that consumers deem essential.

Business owners can adapt their products and services to create more essential value by paying close attention to consumer trends and responses to market conditions. We saw many examples of this phenomenon during the COVID-19 pandemic. Companies shifted business models to stay relevant and meet changing needs; restaurants prioritized takeout programs while in-person dining was restricted; retailers developed the curbside pickup option; gyms pivoted to create on-demand programs for home fitness. Even though these industries likely experienced a decline, companies survived by adapting their offerings to hold value.

If you experience a decline in sales, you can avoid rock bottom so long as your product or service provides essential utility for your customers.

Diversify revenue streams

The ebbs and flows of the business cycle tend to vary across industry. The threat of a recession doesn’t necessarily mean doom and gloom for every industry as macroeconomic trends tend to affect different industries in dynamic ways. It’s an exceedingly rare economic event that challenges companies across all industries.

What’s more common is that a downturn for some will be a boom cycle for others. Diversifying your business and creating multiple, and varied streams of revenue will minimize the impact of any slowdown.

READ: What Are the Safest Industries to Start Your First Business in 2023?

Solidify your capital management strategy

The old adage that cash is king holds true today. It’s no surprise that companies with reliable access to capital are going to be the best positioned to survive and thrive during economic downturns.

Analyze your working capital to identify opportunities for improvement. Can you decrease the amount of cash you have tied up in inventory with better data that allows you to predict demand and make your ordering of products more efficient? Another tactic to improve working capital, sit down with your vendors to identify opportunities for better terms. Finally, diligent credit procedures with your customers may allow you to more quickly convert sales to cash.

As with any area of business, relationships matter when it comes to capital, too. Having a strong relationship with your lenders is essential. Communicate with transparency and form a partnership with those who you borrow money from, ensuring that you are both ready to weather an economic storm together successfully.

If you have a solid financial foundation with accessible capital during a downturn, it can be an excellent time to take advantage of growth opportunities as acquisitions tend to pick up during recessions. Many companies need backing and support when times are tough. For example, the initial success of our business at Kodiak Building Partners was largely established as a result of the 2008 recession and housing crisis. Many of our first operating partners signed on with Kodiak as a holding company during a down period to access the financial strength the model offers. If you have a sound capital management strategy in place, your business is more likely to thrive during a recession.

READ: Recession Ahead — How to Protect Your Financial Plan

Navigating economic downturns is a critical skill for business leaders. No one can predict with 100% certainty where Colorado’s economy will go in the next cycle, but business owners who work to create some protections with well-planned strategies will be better prepared to withstand a downturn, regardless of when the economic headwinds shift.

Steve Swinney is Co-Founder and CEO of Kodiak Building Partners, one of Colorado’s largest privately owned companies. His experience as a financial executive spans more than two decades, with expertise in mergers and acquisitions, private equity-backed ventures, financial analysis, investor relations and overall business strategy.

Steve Swinney is Co-Founder and CEO of Kodiak Building Partners, one of Colorado’s largest privately owned companies. His experience as a financial executive spans more than two decades, with expertise in mergers and acquisitions, private equity-backed ventures, financial analysis, investor relations and overall business strategy.